If you are redesinging a vision system, or thinking aobut a new industiral vision it is good to know what is coming next. Here are some of our thoughts on where we think image sensor technology will continue to go as well as the supporting image processing, optics, and interfaces.

1. Trend #1 From CCD to CMOS even for high-end machine vision and defense systems.

Looking back on this year so far it is clear that CMOS is the image sensor technology of today and thefuture. The announcement from Sony to discontinue CCD manufacturing to invest more in CMOS further supports this as they would only make this decision for good reason. CMOS always had the advantage of higher speeds, offering a higher level of integration, and lower power to enable smaller cameras. Now with the image quality improvements, the benefits of both technologies are combined in CMOS. The latest CMOS image sensors are outperforming CCD in all aspects, including dark current, uniformity, and read noise where CCD previously had the advantage. As a note, it is not all CMOS image sensors performing better than all CCD image sensors. It is just the highest end CMOS image sensors with state-of-the-art processing including advanced global shutter that offer the lower noise, higher dynamic range, etc.

CCD is a mature technology that will continue have a place in certain applications, such as those requiring the extra sensitivity of EMCCD. The high-end CMOS image advances rely on volume production. For lower version programs such as those using very large array sensors, CCDs can also be more cost-effective.

2. Trend #2 Smaller pixels for industrial image sensors.

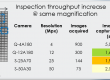

Driven by the consumer market, there has been a constant drive towards smaller pixels to get high resolutions in small packages. One of the benefits of smaller pixels in industrial applications is the ability to get more pixels in the same optical format. This means that possibly you can use the same optics if the MTF works out, and you can definitely increase resolution with the same system outline. With the performance improvements in CMOS as well, this enable inspection and metrology systems to measure smaller structures and more complex structures.

Today’s pixel sizes are 4.5 to 5.5 um (industrial cameras – much smaller in the consumer/ cell phone market). In 2-3 years, industrial sensors will have pixel sizes of 3 to 3.5 um. We anticipate this will be the end of the pixel size race. Now image sensor developers are able to focus on functionality such as improving the global shutter and performance.

3. Trend #3 More image processing in the camera.

With the quality of the image sensors increasing, camera manufacturers can spend less time and energy on defect corrections and more on image processing and functions. While the camera size can be reduced with the lower power of CMOS, the camera needs to be large enough to properly get rid of the heat. This gives the camera designer/manufacturer space to add this other processing such as color processing, image enhancement, digital zoom, rotation, and even more. We see even higher levels of integration and more capacity with processing still to come.

4. Trend #4 Lenses with improved performance at lower cost.

The state-of-the-art Complementary Metal Oxide Semiconductor (CMOS) sensors entering the market have low noise and high Dynamic Range (DR). This high Dynamic Range allows applying more gain maintaining the present day’s requested camera output resolution expressed in bits. As a result the aperture of the lens can be relaxed and selected to balance lens aberrations and lens diffraction. When needed the degree of freedom can even be extended by using a Neutral Density (ND) filter.

The recent developments in CMOS image sensor technology gives more freedom to select those lens parameters that enhancing its performance, e.g. the Modulation Transfer Function (MTF).

With some applications it might even be possible to capture the complete DR of the scene expressed in luminance without the need to control the light flux by means of iris diaphragm or variable ND filter. The latter has tremendous advantages, to mention:

- A lower cost lens

- A significantly more economic lens because of reduced Mean Time Between Failure (MTBF) due to increased reliability as there is no need for moving parts. The MTBF will be that typically encountered for electronic equipment.

- A lens with on average improved image resolution because of the fixed lens aperture optimized for optimal contrast.

- A lens with improved image uniformity, in a sense that the radial falloff in image intensity will be less because of the reduced lens aperture.

- A lens with significantly improved repeatability, because all functions are implemented digitally.

- Last but not least, a lens with a more compact outline, which is more power efficiency and easier to install.

5. Trend #5 USB3 Vision and CoaXPress to gain market share.

While there will likely be no new systems designed around Camera Link, there are many legacy systems that will continue using Camera Link. Many system designers are trying to move towards USB3 Vision or GigE Vision to avoid a frame grabber when either the cable length or speed limitations, respectively, are not a problem. GigE Vision is becoming especially challenging as even HD resolutions require a higher data rate than 1 Gbps and 10 GigE is not taking off since it is not driven by the consumer market. USB3 Vision will likely continue to gain more market share, especially with planned speed increases.

CoaXPress has received acceptance in many high-end, high-speed applications because of the data rates and cable lengths enabled. The defense market in particular appreciates the rugged cable and connectors, and easy implementation. CoaXPress will also gain more market share.

With the efforts to more integrated and compact solutions, current standards will need to reduce bulky and expensive connectors.

What are some of your thoughts on where the industrial vision market is going?

日本語

日本語 English

English 简体中文

简体中文